Sample by My Essay Writer

Summary of problems and recommended solutions

Companies often try but fail to make good solutions to problems in making decisions. They often fail at making these decision because they are confined by bounded rationality. This causes them to take what they think they know to be right about making business decisions and they go more towards what they have done in the past, which is often wrong. This is particularly the case now when so many companies aren’t able to deal with the new economic climate. Many companies fall victim into a false sense of security and this makes they extremely bad at doing things that take into account the new economic times. The economic climate is at a very precarious state and the companies need to recognize that what worked for them five or six years ago isn’t going to work today. Every market has been affected by the recession and this has taken a stranglehold on companies that feel they can continue to do what they have been doing for many years. It is a trap that will result in many companies not performing well. They are so limited by their lack of information about the new economic times and I believe these companies need to have a serious overhaul in staffing, bringing in new and fresh ideas by people who haven’t developed what are now bad habits. These new habits should be taught in school so that a new crop of young and bright professionals can be hired into these companies so that they are able to meet the demands that have arisen due to the performance of the economy in the past several years. What it may appear so, the decisions that these companies are making aren’t entirely irrational, it’s just that they don’t make a lot of sense in the times that we are now living. Companies need to adjust to the demands of the market, like General Electric and so many other companies have changed the way they do business, and this includes the market in which the business is being done. Companies often have the emotional development of humans. At first, we are very enthusiastic about what we are doing, then we become more rational and refined in the way we are conducting our business and then we are perhaps too stuck in the way that we are doing things that there is little room to learn new tricks, (Foster, 2001). < Click Essay Writer to order your essay >

II. Problem and why it is happening. Current economic trends.

A. Companies assume that there will be continuity between the way they did business in the past and the way they are doing business now. But this isn’t the case. There are so many factors that change the climate in which companies operate. These can be political, technological or strictly economical, for example. The stock markets perform better than most companies. Even the great majority of companies on Forbes’ Top 100 don’t perform better than the market. This is because there are so many companies coming into the stock market that are new and are a product of the times. These companies are innovative and they know what to do when it comes to performing to what the market demands of them. As old companies fall out of indexes such as the S&P 500, new companies come on board to take their place and these new companies are performing according to the demand of their times. I believe that many of these new companies are welcomed to these Indexes because they are performing well at the time and then when they are doing very poorly, they are kicked off. And this is the reason why the market indexes are doing better than so many companies out there. The indexes are like a stream that is always flowing, picking up new sediments as it goes along and dropping off old ones that get stuck in practicing business according to previous times. I also believe that the companies that are doing well that come onto the indexes see what the older companies are doing wrong and they find ways to do better than them and, in effect, they end up taking their place. “Joseph Alois Schumpeter, the great Austrian-American economist of the 1930s and ‘40s, called this process of creation and removal ‘the gales of creative destruction,” (Foster, 2001). This process is known to many of these companies, but they are simply unable to dedicate the staff needed to analyze this phenomenon’s impact on the particular business. They need to have a way to manage creative destruction, which is when a company stops doing what was effective and creates a new way of doing things that would make the company competitive in the current market climate. Without doing this, the company stands the risk of failing and being kicked off of the stock market. But even worse than being kicked off of the stock market is failing to earn any profits.

Right now there is so much happening in the market that allows a company to become more efficient at what it does. This is leading companies that are ahead of the curve in technology to take the place of other companies.

B. Without addressing the problem of sticking with what a company thinks it knows as a way of doing business, it will not survive, just as someone who doesn’t put on a jacket in winter in a cold climate won’t survive. Company, just like people, need to adapt to their environment in order to survive.

While some people may believe that these new market conditions are a product of the Internet, they have in fact been developing for a while, (Foster, 2001). There have been trends developing over the past several decades and they are just now starting to explode and this discontinuity is changing the climate for everyone. Because of the changing times throughout the history of corporate America and the Standard and Poors index, there have been various ups and downs in the market, but the general trend is that the average lifespan of companies on the index is dropping. Right now, the average lifespan is about 20 years, but in the 1920s, the average span was 65 years. This discontinuity means that companies need to adjust to survive.

It isn’t noted in the text, however, that many of the companies that have ceased to be listed on the S&P 500 have actually been bought out. Technology and the global economy are creating a climate where it is getting easier to merge. So many of these new and bright companies are attractive to many of the larger business that are trying to stay ahead of the times. For example, right now there is the rumoured acquisition of 3D Systems Inc., by Apple Inc. I don’t think it needs to be explained what Apple does (the iPhone, iPad and computers, for example), but 3D Systems is considered perhaps the largest company in a newly developing sector, and that is of 3D printing. Apple doesn’t have a clue right now about 3D printing, but because the company’s management is smart, they want a piece of the 3D printing market. Many people are sceptic about 3D printing, but whether this type of printing will become an international phenomenon is of no bearing here. The point is that Apple, even though it is one of the strongest companies in America, is focusing on markets that are new. For your information, 3D printers can scan objects and load that into the computer system and then print out that object. Companies are working on printing human organs by using bowel cells from the human body. But the area that has already been mastered, is 3D printing of objects such as cellphone covers. The 3D printers are actually capable right now of scanning an object such as a metal wrench, loading that object into the printer’s computer and then printing out a functional wrench. The wrench isn’t metal, but it is made of a strong material and it can actually adjust as well, because the object was scanned into the computer. It is technology like this, that represents a changing of the times, that will keep companies such as Apple listed on the stock market, and it will keep them profitable. I also want to reiterate that while Forster’s paper “Creative Destruction,” failed to see that a company that is no longer listed on the S&P 500 doesn’t necessarily imply that the company has gone bankrupt, or what-have-you. It is simply that the market is becoming more globalized. I’m not saying that he is wrong to say that there are more profitable companies that are coming onto the market to replace ones that have failed to adjust to the times, but the number he quotes aren’t entirely representational. Furthermore, his fallacy sinks deeper because the S&P 500 is actually accepting more companies onto the listing. Instead of having only large cap companies, the index now accepts small caps, which have a greater chance of not surviving. [Need an essay writing service? Find help here.]

Objectives

* Adapt to survive

* Stay on top of changing in technology

* Add new people to the staff so that fresh ideas are being distributed

* Stop assuming there is continuity

C. Examine problems

There are many problems that are existing for some corporations and the obvious one is that they are not able to adjust to the changing times. But it goes much deeper than that.

III. Possible solutions

A. solution general discussion of possible solutions

The market has the solution to the problem. That solution is most likely the fact that the market is changing all the time. It is so diversified and it is welcoming the best companies onto the index, and these companies are the best in their respective fields. Also, it should be noted that during certain periods, certain companies will do well and others won’t do so well. This makes being as diversified as the S&P 500 an extremely valuable tool. But a company can’t be as diversified as 500 companies. Well, it is possible, but that would be one massive company that operates in so many fields that they would range from a company in the United States looking to create the first functioning human kidney from a 3D printer, to a Chinese company making satellite parts.

So it can be assumed that a company isn’t able to diversify itself as much as the market does. But a company could at least explore other areas within its general field that can help to create a company that is more able to adjust with the times. This company would profit from a sector that is booming, at the same time as it is suffering in a sector that is busting. These profits would generally balance out and some company will be lucky enough to dominate in both, or all, the sectors in which it is a participant.

B. Solution recommendation, why I think this.

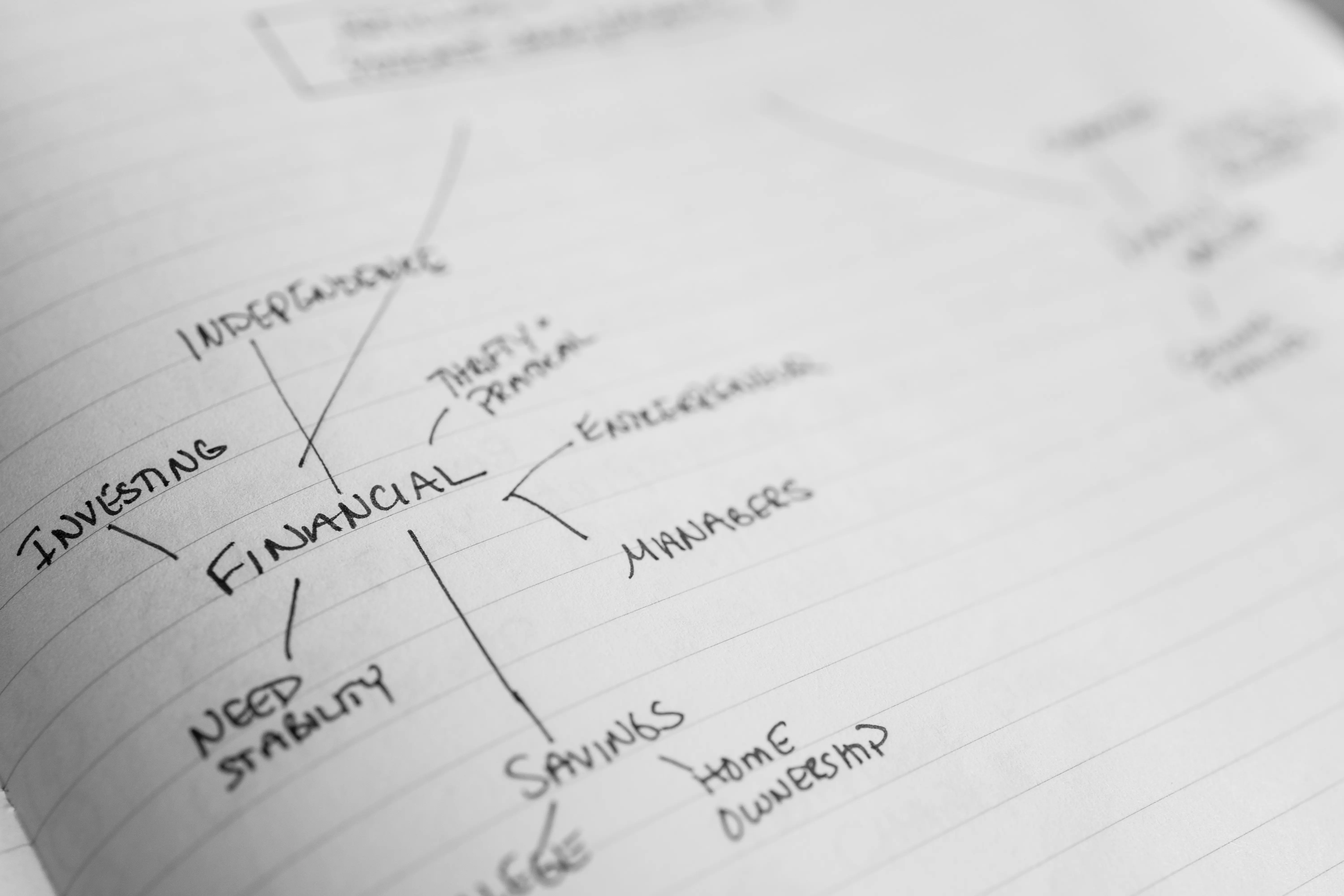

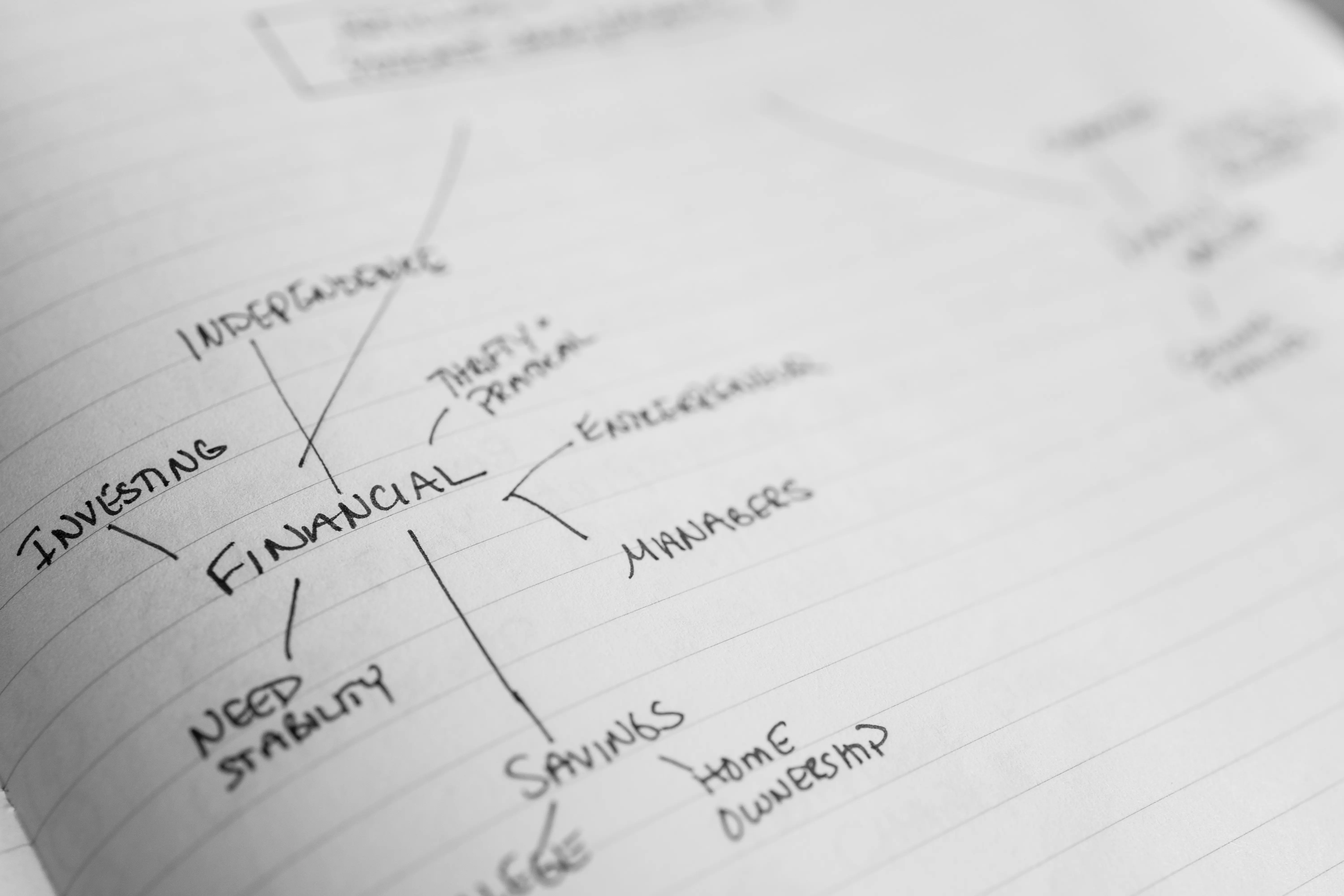

I believe the best solution for a company is to diversify somewhat. This is what many companies have been doing, but I think investment needs to be put into sectors completely different from the one in which the company is mainly operating. This will require larger capital and many companies wouldn’t be able to do it. However, all companies would be able to dedicate at least some of their money into investments. If a company can’t create a sector that is focused on 3D printing, for example, then it can at least buy shares of a company that does.

C. Implementation plan, what changes need to take place for the recommended solution.

To implement a plan that would allow companies to dominate more than one sector, bring, new talent will much enthusiasm and insight into current developments into market trends needs to be hired at the company. [“Write my essay for me?” Get help here.]

Foster, R.N., and Kaplan, S. (2001) Creative Destruction. The McKinsey Quarterly.